Is natural gas a climate problem or a climate solution?

In other words, could natural gas gain during the energy transition?

The industry is certainly selling natural gas as a climate solutions, citing its lower emissions (versus oil and coal), lower cost, and usefulness for balancing solar and wind variability on electric grids. Longer term, it is promoting natural gas plus carbon capture and storage (CCS) as zero emissions energy for electricity and blue hydrogen.

Meanwhile, new studies using satellites show that fugitive methane leakage from the production and transporation of natural gas may be higher than previously estimated. (See, for example, Chapter 6 from our book.) As a result, the true lifecycle emissions of natural gas could be significantly higher unless fugitive methane is brought under control. Finally, recently volatility in natural gas and LNG prices have turned away potential buyers, and renewable energy continues to gain ground.

So could natural gas companies successfully navigate the energy transition?

Here’s one possible scenario:

Phase 1 – In the next five to ten years, users could show reduced emissions by switching to natural gas, since current emissions accounting rules are based on fixed emissions factors. Thus, natural gas could gain at the expense of coal and oil, thanks to its low cost, the electrification of transportation and buildings, and the lower emissions from combusting natural gas. Meanwhile, carbon taxes are being enacted in more jurisdictions. Thus, the successful natural gas companies during this phase will be the ones which benefit from the relative advantage of gas versus coal and oil, have access to infrastructure, and lower emissions versus their peers.

Phase 2 – Further out, the industry would have to address the issue of fugitive methane emissions. Currently several major industry efforts such as OGMP 2.0 are under way with targets set for 2030. Past 2030, we could see companies trying to differentiate their gas based on their full lifecycle emissions, including those from production and transportation. If natural gas companies and users need to account (and pay) for lifecycle emissions, then those companies which have made the investments to reduce them will be better positioned for this phase of the energy transition.

Phase 3 – Into the 2040’s, natural gas would increasingly be used as a supplementary energy source to renewable energy to produce electricity and hydrogen. Users would start demanding emissions captured by CCS to offset the lifecycle emissions of their natural gas. Successful natural gas companies during this phase of the transition would offer both natural gas and CCS, which is really gas in reverse (see Chapter 7 of our book.) Gas produced with lower lifecycle emissions, including low fugitive methane, would be at a further premium to those with high emissions.

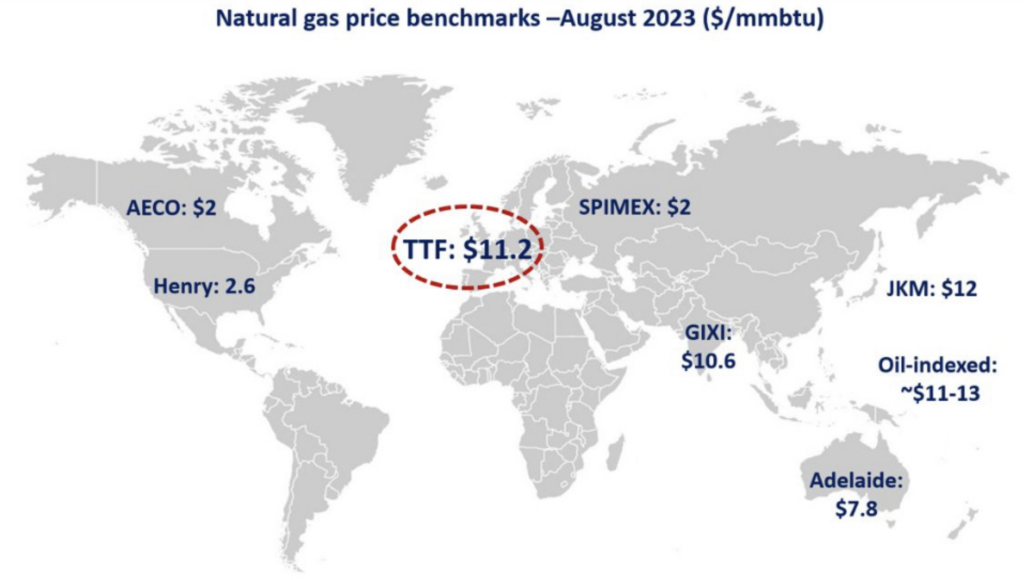

The capital costs to reduce fugitive methane emissions and CCS would add to the price of natural gas. Fortunately, there is room to go up. Currently, there is a large difference in natural gas prices between the producing and consuming markets:

Source: GlobalLNGHub.com

This shows that the value of natural gas is much higher than the cost to produce it, thanks to its ability to provide on-demand, dispatchable energy. If wind and solar costs continue to decline, natural gas could become even more valuable as a dispatchable energy source that balances their variability. Therefore, although overall natural gas use would eventually decline, natural gas prices could rise sufficiently to compensate companies which make the investment in emissions reductions and CCS.