Where do refineries go from here?

After the runup in refining margins, the market seems to be pricing to a return to normal. In reality, though, they’re at the crossroads of several trends which offer both opportunities and risks:

- The transition to EV’s will reduce gasoline demand over time.

- Heavy transportation may also become more electrified over time, reducing demand for diesel.

- Alternatively, heavy transportation may continue to rely on diesel, but low carbon fuel and renewable diesel standards will create compliance costs for refineries which do not produce diesel that meet those standards.

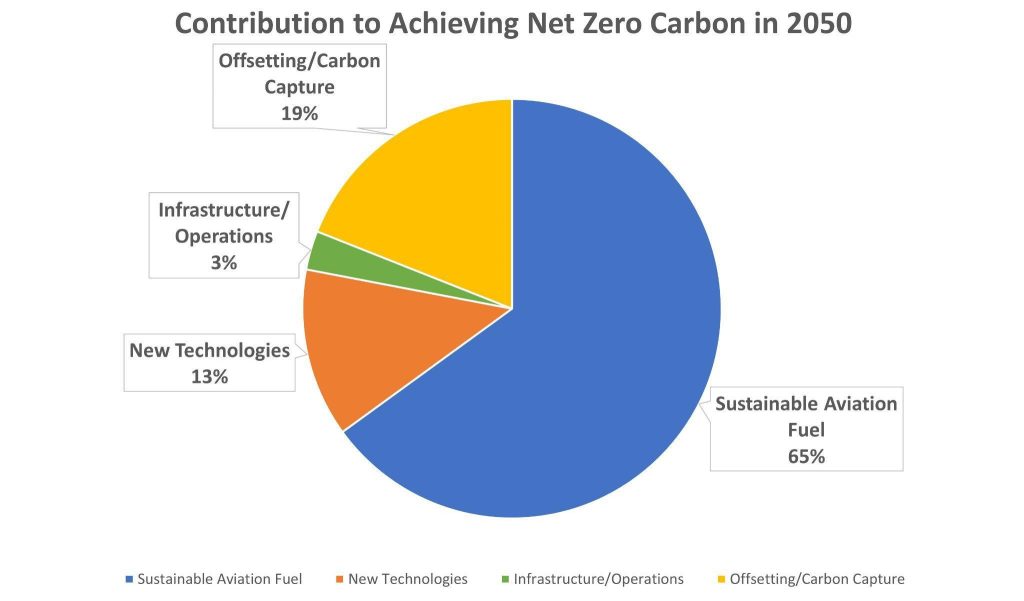

- Airlines are turning to sustainable aviation fuels (SAF) as their main energy transition strategy, creating huge demand for SAF:

From Chapter 8, Sustainable Aviation and Transporation Fuels, Sustainable Oil and Gas using Blockchain based on data from IATA

- Conversion of refineries to produce renewable diesel and SAF will further reduce traditional petroleum refining capacity, which has already been falling as older, smaller refineries have been closing.

The confluence of these trends offers refineries a path forward towards a sustainable business model: Converting refineries reduces existing petroleum refining capacity, thus improving their refining margins and cashflows. Meanwhile, investing those cashflows to convert refineries would result in higher valuations for the refineries, which could help raise additional capital to convert more refineries. If done correctly, this could actually result in a virtuous cycle of higher cashflows leading to higher valuations leading to higher cashflows.

Such a transition would not necessarily be easy. Low carbon and renewable fuels are valued based on their lifecycle emissions, which means the refiners must be able to produce them efficiently with the lowest emissions footprint. Aviation fuel is also a smaller market than gasoline, which means that ultimately, the market for liquid fuels will be smaller.

The downside, however, is that the refiner may move too slowly, because it’s too leveraged or too focused on maximizing cashflows versus valuation. In that case, it could be stuck with rising compliance costs for renewable fuel credits and falling demand for refined output.

Thus, while the market today is valuing most refineries at low multiples, the energy transition in fact offers upside for refiners which are able to seize the initiative and move quickly into the new markets of SAF and renewable fuels.