This data set of oil and gas companies’ emissions and energy transition strategies is an extension of topics discussed in our book. It’s designed for analyzing the investment merits of companies based on our investing premise, rather than their traditional ESG compliance. Thus, the metrics contain both financial and emissions data, as well as our interpretation of the companies’ announced strategies. The metrics differ by industry segment as relevant to their businesses, but generally they include the following information:

- Operating results — Amount of GHG emissions, absolute and versus output levels.

- Quality of disclosure — See below.

- Management strategy – Based on letters to shareholders and sustainability reports.

The data set currently covers the following major U.S. publicly traded oil and gas companies:

Upstream and Integrated:

- Pioneer Natural Resources (PXD)

- Occidental Petroleum (OXY)

- Exxon Mobil (XOM)

- Chevron (CVX)

- EOG Resources (EOG)

- Conoco Phillips (COP)

- Devon (DVN)

- Hess (HES)

- Diamondback (FANG)

- Coterra (CTRA)

- APA (APA)

- EQT (EQT)

Midstream:

- Williams (WMB)

- Kinder Morgan (KMI)

- ONEOK (OKE)

- Targa (TRGP)

Downstream:

- Marathon Petroleum (MPC)

- Phillips 66 (PSX)

- Valero (VLO)

Services:

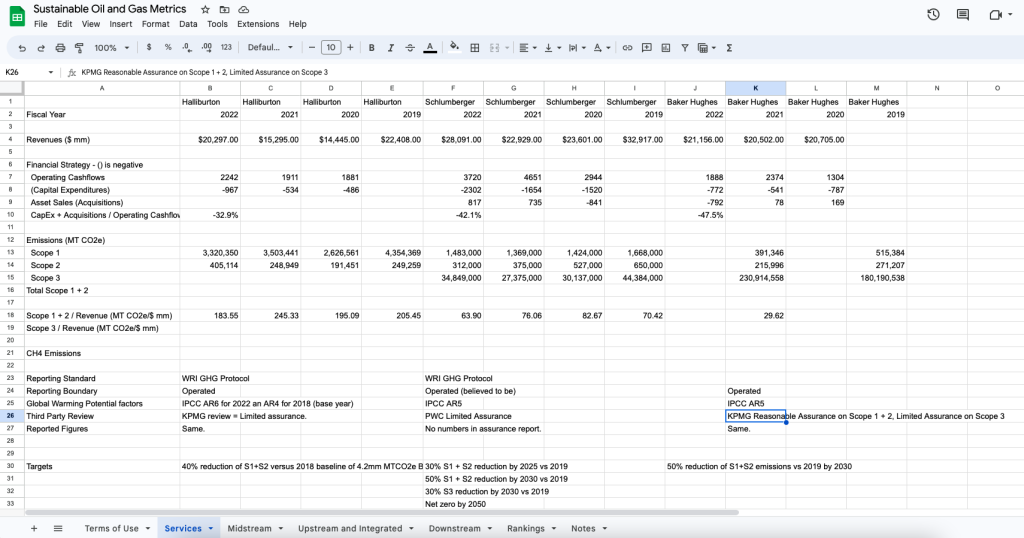

- Halliburton (HAL)

- Schlumberger (SLB)

- Baker Hughes (BKR)

The data is compiled from companies’ public filings, such as 10-K reports, and their sustainability reports. There was a lot of data available, we’re grateful to all the companies for making the effort to share so much detail about their businesses. Most of the data is self explanatory. However, we would like to highlight the following issues with disclosed emissions data:

Scope of Disclosure

Almost all companies disclose Scope 1 (direct energy use) and Scope 2 (indirect purchased energy) emissions. Some companies also disclose Scope 3 (supply chain) emissions. The disclosed Scope 3 emissions, however, differ across companies. For the oil and gas industry, the important Scope 3 emissions are:

- Category 9 – Downstream transportation and distribution

- Category 10 – Processing of sold products

- Category 11 – Use of sold products

Of these, category 11 is the most important by at least a factor of 10x. If the company has at least released Scope 3 Category 11 emissions data, then it is included as Scope 3 emissions. If the company has released “Scope 3 emissions” which does include cover Category 11 or which does not cover all of its major businesses, then it is not included. For example, one company released its employee travel emissions as its “Scope 3 emissions,” and this was not included in the data set.

Threshold of De Minis Facilities Emissions

There is also some discrepancy between Scope 1 and 2 emissions. Most emissions are based on the U.S. EPA GHG Mandatory Emissions Reporting (40 CFR Part 98), including Subparts NN and W. However, there is a difference in what facilities are included. EPA rules do not require emissions disclosures for facilities which emit less than 25,000 tons CO2e per year. The AXPC (American Exploration and Production Council) ESG Framework calculates GHG emissions intensity of output (i.e., kg CO2e/barrel) based on EPA disclosed emissions. Therefore, it is also only based on facilities required by the EPA rules. In contrast, IPIECA/API guidelines calls for including disclosure of emissions up to a de minis amount and should include almost all facilities of the companies.

Third Party Assurance

Most, but not all, companies have engaged their auditor or another third party to provide assurance about their disclosed emissions. Of those, most companies have received a “Limited Assurance” rather than a “Reasonable Assurance.” Limited Assurance means that after a review, the auditors found nothing wrong. Reasonable Assurance means that after a more detailed review, the auditors believe that the disclosures reasonably represent the company’s actual results. The latter is the level given to the companies’ financial disclosures. The SEC may be moving towards requiring Reasonable Assurance for emissions disclosures in the future.

Consolidation of Subsidiaries and Joint Ventures

As explained in the IPIECA/API guidelines, emissions can be reported on an Operated or Equity basis. Operated means they are for facilities operated by the company, whereas equity includes the company’s share of joint ventures and subsidiaries, pro-rated by its share of equity ownership in them.

In the oil and gas industry, however, many companies have subsidiaries whose results are consolidated in full on the companies’ results, even if the company does not own 100%. Instead, there is a deduction for outsider shareholders’ portion in the consolidated balance sheet and income statements. The IPIECA/API guidelines refers to this as a “Financial” consolidation, and there is currently no consolidation of emissions which is consistent with this consolidation of financial results.

This means, unfortunately, that while an emissions to revenue metric would be useful, it would be unreliable across individual companies.

Sustainability vs Financial Report Figures

We’ve generally included emissions figures from sustainability reports and overall volume figures from financial reports (10-K’s). This is because not all companies include volume figures in sustainability reports. For those that do, however, this may lead to some discrepancy between our calculated metrics, such as carbon intensity, and those in sustainability reports. For example, one company’s investor relations department told us that

We report gross production in the Sustainability Report and net production in our annual reports (10-Ks)

Errors and Omissions

We apologize for any errors, omissions, and opinions which may be different from yours. Of course, while we found this data set very useful, we could not guarantee that it’s correct or useful to you. Any use of this data set is contingent upon your acceptance of the full disclosures and terms included with them, but if you have any disagreements with the data, please Contact Us.

Getting the Data Set

To get the data set, please enter your name and email address below. The data set will be emailed to you. You will also receive occasional updates about our work, including updates to the data set. If you do not wish to receive these updates, please Contact Us, and we will unsubscribe you.