Low valuations of oil and gas companies relative to their cashflows will spur mergers and acquistions in the industry, and sustainability will become a key determinant of value. This creates opportunities for companies to establish themselves as sustainability leaders and for investors to profit from identifying them early.

The sustainable oil and gas energy transition is on!

If you believe companies’ sustainability reports, that is.

Filled with photos and charts, just about every oil and gas company is promising to do its part by reducing operational and methane emissions and investing in everything from carbon capture and storage to sustainable biofuels and hydrogen — all technologies discussed in our book.

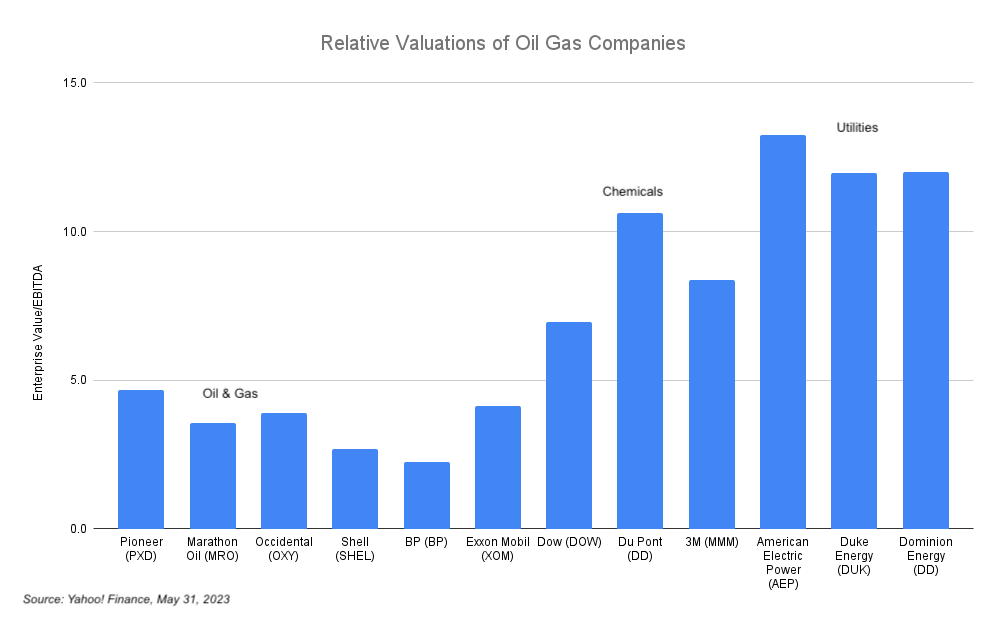

Unfortunately, investors aren’t buying it. Take a look at the relative valuations of the oil and gas industry compared to either chemicals or utilities:

Here it is in more detail:

| Market Cap ($bn) | Enterprise Value/ Revenue | Enterprise Value/ EBITDA | |

| Oil & Gas | |||

| Pioneer (PXD) | 54.73 | 2.4 | 4.7 |

| Marathon Oil (MRO) | 19.77 | 2.69 | 3.6 |

| Occidental (OXY) | 80.43 | 2.27 | 3.9 |

| Shell (SHEL) | 243.74 | 0.63 | 2.7 |

| BP (BP) | 139.68 | 0.56 | 2.3 |

| Exxon Mobil (XOM) | 437.51 | 1.11 | 4.1 |

| Pipelines | |||

| Williams (WMB) | 59.44 | 5.16 | 9.2 |

| Kinder Morgan (KMI) | 70.09 | 3.73 | 16.6 |

| Oneok (OKE) | 40.65 | 1.89 | 9.2 |

| Chemicals | |||

| Dow (DOW) | 50.39 | 0.94 | 7.0 |

| Du Pont (DD) | 32.96 | 2.58 | 10.6 |

| 3M (MMM) | 69.34 | 2.07 | 8.4 |

| Utilities | |||

| American Electric Power (AEP) | 90.30 | 4.57 | 13.2 |

| Duke Energy (DUK) | 152.60 | 5.26 | 12.0 |

| Dominion Energy (DD) | 94.49 | 5.21 | 12.0 |

While a simplistic measure like enterprise value to EBITDA alone cannot be used to make investments decisions, it does tell the story: Despite record energy prices and profits of 2022, oil and gas companies are far less valuable per dollar of revenue or earnings. Even oil and gas pipelines, which operate under long-term contracts, have much lower valuations than utilities with similar infrastructure-based business models.

In other words, investors don’t believe that “the world will always need oil.” Nor do they give much credit to companies’ net zero promises or pivots to renewable energy. Instead, these market prices imply that the high energy prices of 2022 won’t last, and the risks of climate change and the energy transition away from fossil fuels are too great.

This is not sustainable–from a financial point of view.

Unless these low relative valuations to cashflows improve, they will tempt buyers of all sorts: private equity funds, activist shareholders, acquirers from other industries, and, of course, other oil and gas companies. Private equity funds, for example, could buy oil and gas assets and milk them for the remaining cashflows. This would eventually lead to a winding down of the companies, but it’s profitable as long as they buy cheap.

Public companies could pay more, as long as there is a “strategic fit.” For example, utilities could buy pipelines, chemicals and industrial companies could buy to lock in their energy supplies (like U.S. Steel once did buying Marathon Oil), or high flying new energy companies could buy to bulk up (like AOL-Time Warner). The key for all these buyers is proving that strategic fit, which means buying assets with low climate and energy transition risks, lest the acquisition drags down their own valuations.

Meanwhile, some oil and gas companies are trying to boost their valuations by buying back stock, a strategy that would also lead to a winding down of the company. Others are reinvesting their cashflows in renewable energy. This would be a good strategy if there are synergies with existing businesses. Otherwise, it could be difficult to convince investors to properly value the renewable energy business inside an oil and gas company. Eventually this would invite activist shareholders to call for a break up of the company.

Finally, oil and gas companies are buying each other. Some may be buying to consolidate, reduce costs, and milk the remaining cash flows, just like private equity investors. Others may be looking to buy as part of their climate and energy transition strategy, in hope that they could convince investors that they will emerge as leaders in the energy transition. If they’re successful, they could be rewarded with higher valuations, then grow by buying up their competitors, further boosting their valuations. These acquirers would need to buy assets and companies with better climate and emissions performance.

In other words, unless the plan is to wind down, sustainability will become the key to increasing the valuation of oil and gas companies and their assets.

For oil and gas companies, this means thinking through what business model would convince investors you’ll be successful in the energy transition, and how to prove it to them. Let’s take carbon capture as an example. Is it a viable strategy for a sustainable oil and gas company? If so, how much are you investing in it relative to your oil and gas assets? How much of that is for enhanced oil recovery, and how much for net additional removal of CO2 from atmosphere? Are you monetizing the removed CO2 as carbon credits or as carbon-neutral energy for your customers? Do you have the data to satisfy government regulators and the general public?

For investors, this means taking a balanced approach towards oil and gas investing. Yes, demand for oil and gas will fall, but we’ll still need lots of it for several decades. There will be room for oil and gas companies which could operate sustainably. In fact, such companies could not only survive but even grow, and they rightfully deserve higher valuations. It will be up to us to dig through the disclosures from all the different oil and gas companies to find the ones that will lead in the energy transition.

The key for both sides is disclosures, backed up by credible proof and data — the subject of our book.

In the next posts, we’ll look at how to identify the energy transition leaders with oil and gas disclosures, and how industry M&A activity is already reflecting the energy transition. Please sign up below for updates.