Midstream assets, including pipelines, storage tanks, LNG, and tankers have relatively stable cash flows and are difficult to replace, making them attractive to many long-term investors. Properly analyzing midstream companies, though, involves studying their structures, business mix, leverage, derivatives, and increasingly, the effects of the energy transition.

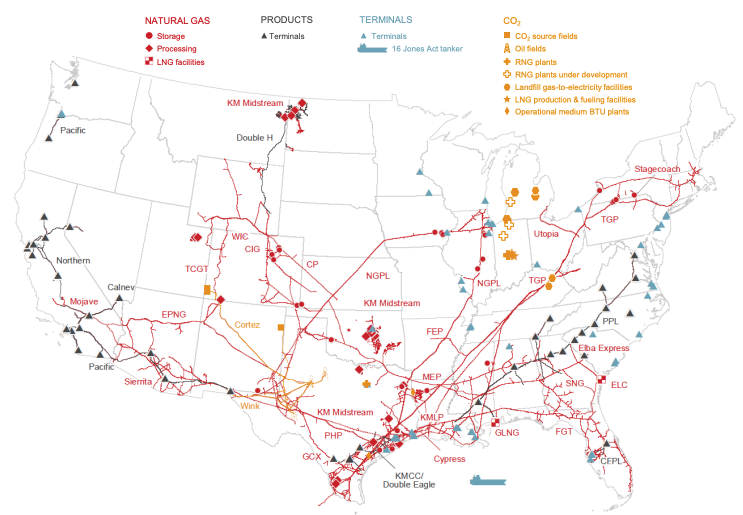

A Representative Midstream Value Chain. Source: Kinder Morgan

The energy transition will impact midstream in two important ways. First, midstream companies are very energy and therefore emissions intensive operations. Several midstream companies in our data set could have operational (Scope 1 and 2) emissions of nearly 2,000 tons CO2e per $1 million of net revenue. Further, these reported emissions may understate the effect of methane leakage, as satellite methane monitoring is starting to show. As more markets become subject to carbon emissions taxes, these high levels of emissions could be a significant drag on their financial results: A $100 per ton carbon tax would reduce EBITDA and net income by 10% to 20% of revenues.

Thus, companies which get ahead of the curve by improving their operations and reducing emissions would do better than the rest.

Second, the energy transition will make what a midstream company services important. Is it transporting natural gas from low emissions producers? Or is it transporting carbon intensive synthetic oil? As energy consumers become subject to emissions taxes or try to meet their own emissions targets, products with higher lifecycle emissions will be adversely affected by the energy transition. The midstream assets (and companies) which service them would thus face diminishing demand.

Would Scope 3 emissions disclosures help investors analyze this risk?

While aggregate Scope 3 emissions could help identify the emissions intensity of the serviced products, it is not enough. Like a loan portfolio, it is not the average that matter. What matters is the percentage of high Scope 3 emissions intensity products in the companies’ business mix. Therefore, investors and analysts would still need to dig deeper to understand the actual business mix at the midstream companies to understand their energy transition risk/reward profile.

Today the market seems to be pricing midstream companies primarily based on dividends and EBITDA. As the energy transition brings both carbon taxes and demand shifts, we would expect to see a tiering between companies and assets that have lower operational emissions and that service lower emission intensity products. While standard GHG emissions disclosures could help identify these companies, it will also be important to analyze midstream companies in detail to get a true picture of where they stand.

Of course there is still time. Time for carbon taxes to come in to being. Time for companies to prepare. But do we ever have as much time as we thought?